PORTFOLIO

Internship: Symba

Feb - May 2020

Highlights

HTML, CSS,

Javascript, Flask,

Babel, PostgreSQL,

Express.js, Node.js,

AWS (S3, RDS), Git

Software Engineering Intern

Symba Intern Management Platform, San Francisco (Remote), CA

• Designed and extended a web-based platform that provides a novel solution in remote internship and staff management

• Delivered new features and managed progress via Agile development practices and used Git for version control

• Implemented a vector-based match-making algorithm to connect students with hiring managers on a skill-based setting

• Developed SQL schemas, tables, relations, automated backend commands and deployed backend on AWS storage and database servers (RDS and S3)

• Constructed an efficient and interactive user interface using React.js

Project: Online Survey Platform

In Progress

Highlights

HTML, CSS

Javascript, Babel

MongoDB (Atlas), Express.js,

Node.js, Passport.js

EJS, Git

Online Survey Platform

Cornell University, New York, NY

• Building a full-stack online survey platform for classmates and professors to initiate or submit anonymous online lecture feedback, featuring an unique graphical UI to hold attention, maximize user experience, and minimize time spent

• Designing schemas and manipulating database using MongoDB Atlas cloud server

• Handling backend HTTP responses using Express.js, Node.js and managing user credentials using Passport.js

• Utilizing React, Bootstrap and open-source libraries to display information, and adapting UI to different devices (laptops, browsers, smartphones, etc.)

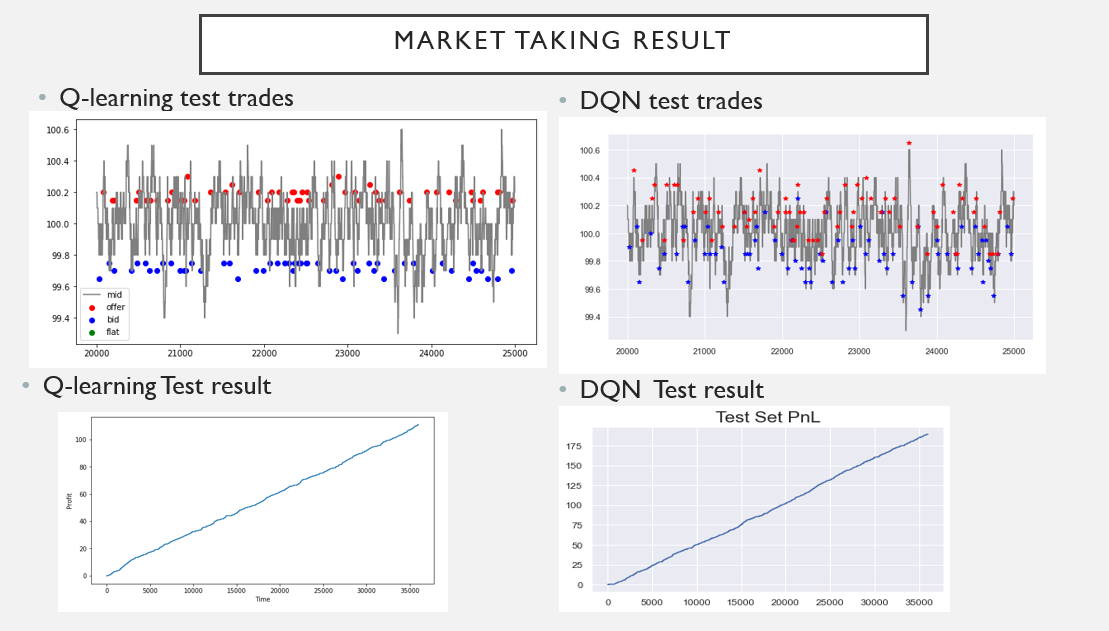

Project: Reinforcement Learning Research

Sep - Dec 2020

Highlights

Python, Numpy

TensorFlow

Reinforcement Learning

Neural Networks

Real-world Problem

Reinforcement Learning Research Student

Cornell University, New York, NY

• Applying reinforcement learning (Q-learning and Neural Networks) to high frequency market data to maximize profits

• Developing hypothetical test data using different statistical models based on prior assumptions

• Streamlining ML algorithms such as Naïve Bayes, Decision Trees, KNN and Random Forests to analyze input features

• Developing visualizations such as 3d-plots, heatmaps and animated plots for monthly presentations

• Backtesting optimal strategy on real data after successfully creating profitable traders in the simulated environment

Intern: Wisdom Capital

May - Sep 2020

Highlights

Python

Machine Learning

Statistics

Conference Papers

Independent Research

Quantitative Developer

Wisdom Capital Assest Management, New York, NY

• Focused on analyzing, developing, and backtesting a variety of trading strategies

• Developed risk models and risk-neutral-density stock price forecasts based on short maturity option volatility smiles

• Built proficiency in several data sources, such as Bloomberg, Option Metrics and CBOE

• Organized and cleaned multiple sets of time-series data for backtesting in Python

• Communicated summaries and analysis of results to team via weekly group presentations

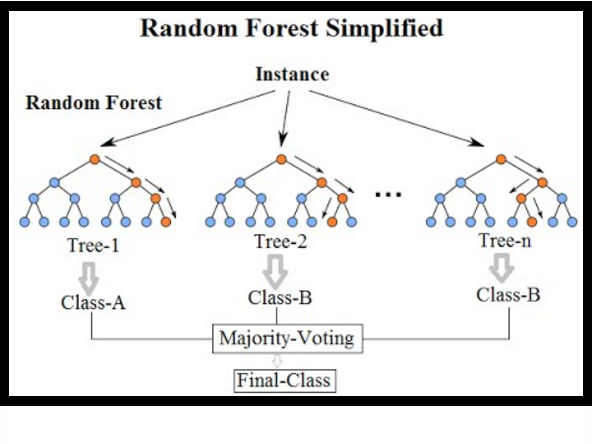

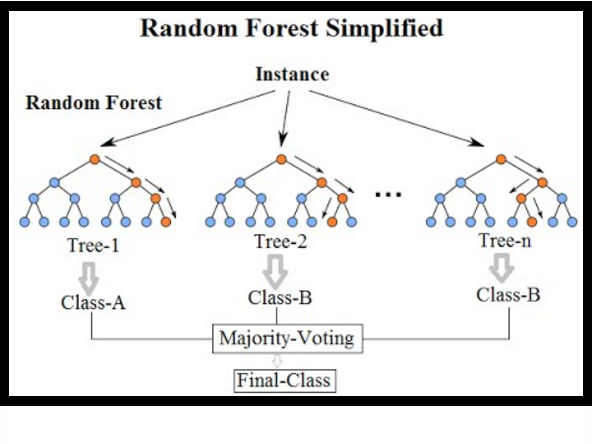

Project: Stock Selection with Machine Learning

Feb – May 2019

Highlights

Python, SQL, Scikit-Learn

Random Forest

Accuracy Competition

Stock Selection with Machine Learning

New York University, New York, NY

• Classified stocks from NASDAQ in order to differentiate high-performance stocks based on historical data

• Queried stock prices using SQL and converted non-numerical values to numerical values

• Preprocessed data through by generating additional features and queried stocks using SQL

• Grew a Random Forest classifier with 100 decision trees and 6 splitting features and analyzed multiple simulations to prove stability of model, and achieved an average monthly annualized return of 16%

Project: Portfolio Optimization

Feb - May 2020

Highlights

Python, MatLab

Markowitz Optimization

Momentums, RSI, Quantile Trading

Backtesting

Portfolio Optimization

Cornell University, Ithaca, NY

• Constructed a trading strategy based on momentums and portfolio optimization and proved stability via backtesting

• Applied relative strength index and quantile trading methodologies to select stocks from NASDAQ 100 index

• Developed a Markowitz optimization algorithm that assigns weights to stocks based on user risk preferences

• Backtested strategy over a 10 year horizon and beat the benchmark annual return by an average of 40%

Intern: Société Générale Bank

May - Aug 2018

Highlights

Excel, VBA

Visualization, Presentation

Bloomberg, Libor

Option Pricing

Global Markets Summer Analyst

Société Générale Bank, Beijing, China

• Developed Excel macros to process and visualize daily data changes, and synthesized stock data, trading data and client account balances from different departments to support senior management

• Priced LIBOR based swaps and options with Bloomberg, designed pitch books, and created presentations for clients

• Verified data integrity after software upgrades of the bank’s core system and data transfer between databases

Connect

Connect